RSA: ETI – Covid-19 Relief Measures

PLEASE NOTE: These are unprecedented times which may lead to ever-changing information.

The information that follows is up to date at the time of compiling this document and releasing our software Release 5.4b.

Please ensure that you are registered on Sage City to remain updated with any changes and product-specific information.

The Ministry of Finance published the Disaster Management Tax Relief Bill and the Disaster Management Tax Relief Administration Bill on 1 April 2020. These Bills provide for relief measures for Employment Tax Incentive (ETI) and PAYE.

Although not promulgated yet, these Bills provide the necessary legislative amendments required to implement the COVID-19 tax measures.

These changes are effective 1 April 2020 – 31 July 2020 (4 months).

Therefore, this will apply to the EMP201 of April which must be submitted before the 7th of May and will apply until July 2020 for which the EMP201 must be submitted before 7 August 2020.

The changes include the following:

-

Amendments to the ETI values.

-

Employees who qualified for ETI and already reached 24 months will qualify for another 4 months.

-

Employees who are 30 to 65 years old on the last day of the calendar month (April 2020 – July 2020), who meet all criteria also qualify now.

These relief measures ONLY apply to employers who are registered as an employer with SARS for employees’ tax purposes on or before 1 March 2020.

For more details regarding the background of ETI, consult ‘COVID-19_Relief_Measures_Affecting_Payroll.pdf’ on Sage City.

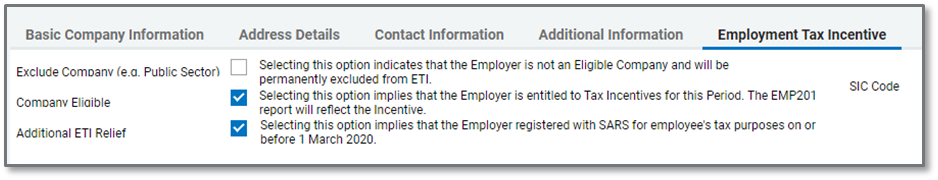

Main Menu > Company > ETI Setup > Select <Company Setup>

Since these relief measures only apply to employers who are already registered with SARS for employees’ tax purposes before 1 March 2020, a new tick box has been added to indicate whether this relief applies to you or not:

The ‘Additional ETI Relief’ option is only visible from March 2020 and is flagged during the conversion process.

If you only registered as an Employer with SARS for employees’ tax purposes on or after 1 March 2020, you must unselect this option.

This selection will only be considered during the 4 months period (April 2020 – July 2020), thereafter, the tick will be ignored by the system for the ETI calculation.

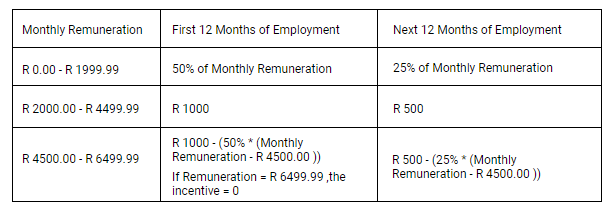

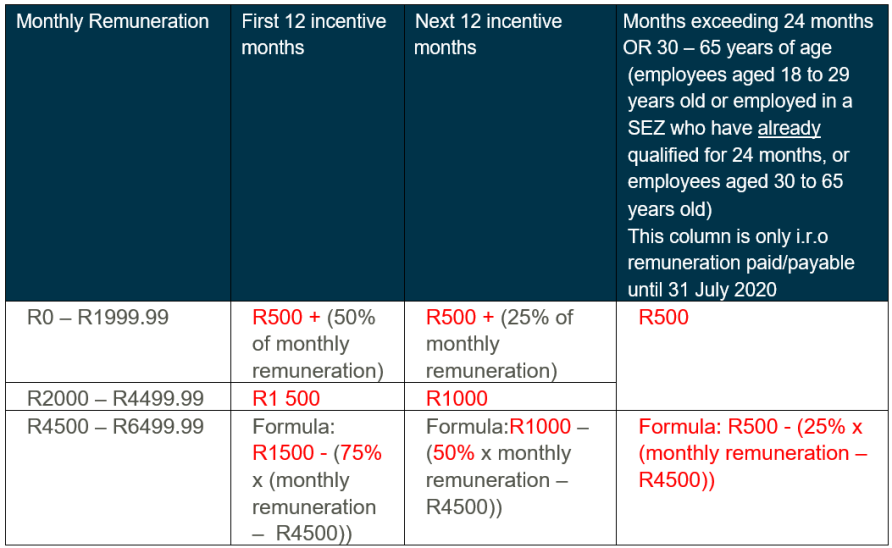

The Employment Tax Incentive Table has been amended to accommodate the Additional ETI Relief.

The Employee ETI History > Summary Tab

(Main Menu > Payroll > Payslip Information > Select Employee > Click on <ETI>)

displays the ETI Table before the Additional ETI Relief was introduced.

The table for the Additional ETI Relief is found in the <ETI Calc Info> document, at the bottom of this Screen.

The table on the Employee ETI History Summary Tab has remained unchanged and is applicable:

-

from 1 January 2020 – 31 March 2020,

-

in companies where the Additional ETI Relief tick has not been flagged on the ETI Company Setup Screen, and

-

from August 2020.

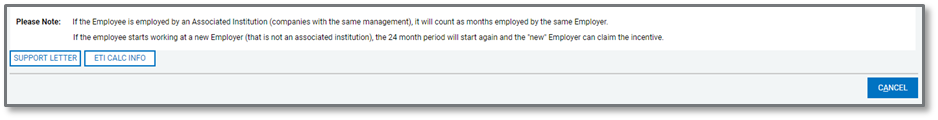

The <ETI Calc Info> document is found at the bottom of this screen.

The ETI Table increases for the period 1 April 2020 – 31 July 2020 (4 months) for Employers flagged to receive the Additional ETI Relief. The changes are indicated in red:

This refers to qualifying employees, meaning all other qualifying criteria are met (date of engagement/ID, asylum seeker permit or refugee/receives at least minimum wage/receives monthly remuneration of less than R6 500, etc.), aged 18 to 29 years old on the last day of the calendar month, who have already qualified for 24 months can qualify for an additional 4 months (for the above period, if all other qualifying criteria are met).

-

The incentive will be a fixed amount of R500 per month.

-

The ETI Set will be 3.

-

If less than 160 hours is worked, the Gross Up calculation for remuneration will be used, but ETI will not be a pro-rata value. (If the Factor is unequal to 1, the ETI value will be equal to R500.)

This refers to qualifying employees, meaning all other qualifying criteria are met (date of engagement / ID, asylum seeker permit or refugee/receives at least minimum wage/receives monthly remuneration of less than R6 500, etc.), aged 30 to 65 years old on the last day of the calendar month, will qualify for 4 months (for the above period, if all other qualifying criteria are met).

-

The incentive will be a fixed amount of R500 per month.

-

The ETI Set will be 3.

-

If less than 160 hours is worked, the Gross Up calculation for remuneration will be used, but ETI will not be a pro-rata value. (If the Factor is unequal to 1, the ETI value will be equal to R500.)

If you have any employee’s qualifying for ETI based on the 2 new qualifying conditions for the period 1 April 2020 – 31 July 2020, ensure that all relevant fields on the ETI Screens (Employee > Change Employee > ETI Tab) is completed and that the Minimum Wage values and Hours fields required for the calculations are correct.

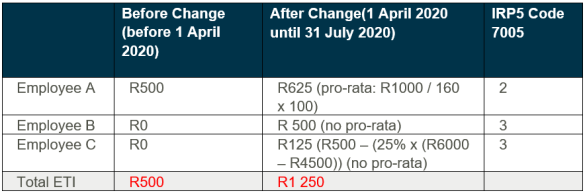

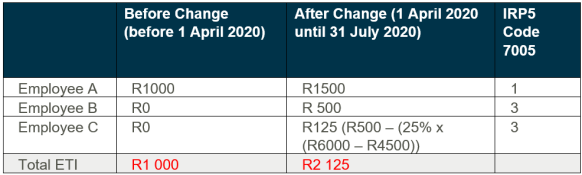

Example 1:

Employer XYZ employs 3 qualifying employees:

-

Employee A (aged 22): Has qualified for ETI 4 times before April 2020, the month of April is his 5th qualifying month. All qualifying criteria are met. The employee’s monthly remuneration is R3 500.00. Employed and remunerated for a full month.

-

Employee B (aged 28): Has qualified for ETI 24 times before April 2020. All qualifying criteria are met. The employee’s monthly remuneration is R3 000.00. Employed and remunerated for a full month.

-

Employee C (aged 40): Has not qualified for ETI before. All qualifying criteria are met. The employee’s monthly remuneration is R6 000.00. Employed and remunerated for a full month.

Example 2:

Employer XYZ employs 3 qualifying employees.

-

Employee A (aged 22): Has qualified for ETI 14 times before April 2020, the month of April is his 15th qualifying month. All qualifying criteria are met. The employee’s monthly remuneration is R3 500.00 (grossed-up remuneration). Employed and remunerated for 100 hours.

-

Employee B (aged 28): Has qualified for ETI 24 times before April 2020. All qualifying criteria are met. The employee’s monthly remuneration is R3 500.00 (grossed-up remuneration). Employed and remunerated for 100 hours.

-

Employee C (aged 32): Has qualified for ETI 5 times before. All qualifying criteria are met. The employee’s monthly remuneration is R6 000.00 (grossed-up remuneration). Employed and remunerated for 100 hours.